The Financial Crimes Enforcement Network (FinCEN) was busy last week issuing two Notices of Proposed Rule Making (NPMR) and an adjustment to Civil Money Penalties (CMP).

The purpose of the first NPRM is for interested parties to comment on the application that will be used to collect information from individuals who seek to obtain a FinCEN identifier, consistent with the Beneficial Ownership Information.

The second NPRM is requesting comments for the report that will be used to collect beneficial ownership information, as required by the Beneficial Ownership Information Reporting Requirements final rule.

Both of these proposals were issued in response to the final BOI reporting rule that requires certain legal entities to file with FinCEN reports identifying the beneficial owners of an entity. Entities created or registered to do business on or after January 1, 2024 must also identify the individual who directly filed the document with specified governmental authorities that created the entity or registered it to do business, as well as the individual who was primarily responsible for directing or controlling such filing if more than one individual was involved in the filing of the document. The regulations go on to describe who must file a report, what information must be provided, and when a report is due. Entities must certify that the report is true, correct, and complete.

These regulations implement Section 6403 of the Corporate Transparency Act (CTA), enacted into law as part of the National Defense Authorization Act for Fiscal Year 2021 (NDAA). The requirements are intended to help prevent and combat money laundering, terrorist financing, corruption, tax fraud, and other illicit activity, while minimizing the burden on reporting entities. Comments on the proposals are due on March 30, 2023. FinCEN also included a fact sheet to help navigate the different components of the CTA.

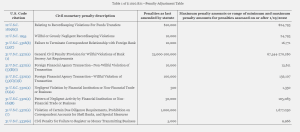

In addition to the NPRMs, FinCEN also released adjustments to CMPs for inflation as mandated by the Federal Civil Penalties Inflation Adjustment Act of 1990. This rule adjusts certain maximum civil monetary penalties within the jurisdiction of FinCEN to the amounts required by that Act. The method of calculating CMP adjustments applied in this final rule is required by the Act. The following table deficits the reflected changes for 2023.